The U.S. dollar has imploded since U.S. President Donald Trump unleashed his tariff tantrum against the world economy, with the U.S. dollar index down 8.5 this year. The index measures the greenback’s value against a basket of major currencies, including the Canadian dollar. But the loonie has run into a wall where other major currency players are concerned. Haven currencies are linked to countries that have reliable legal systems and institutions, wide-ranging economies, large net international investment positions — meaning they hold more assets globally than foreign investors hold in their countries — and are net lenders to the world. “Canada meets the first two requirements: it is well-respected and considered a safe place to invest,” Schamotta said. “But it is heavily reliant on the U.S. economy for export demand, often runs a trade deficit and is a relatively small net creditor in international financial markets.”

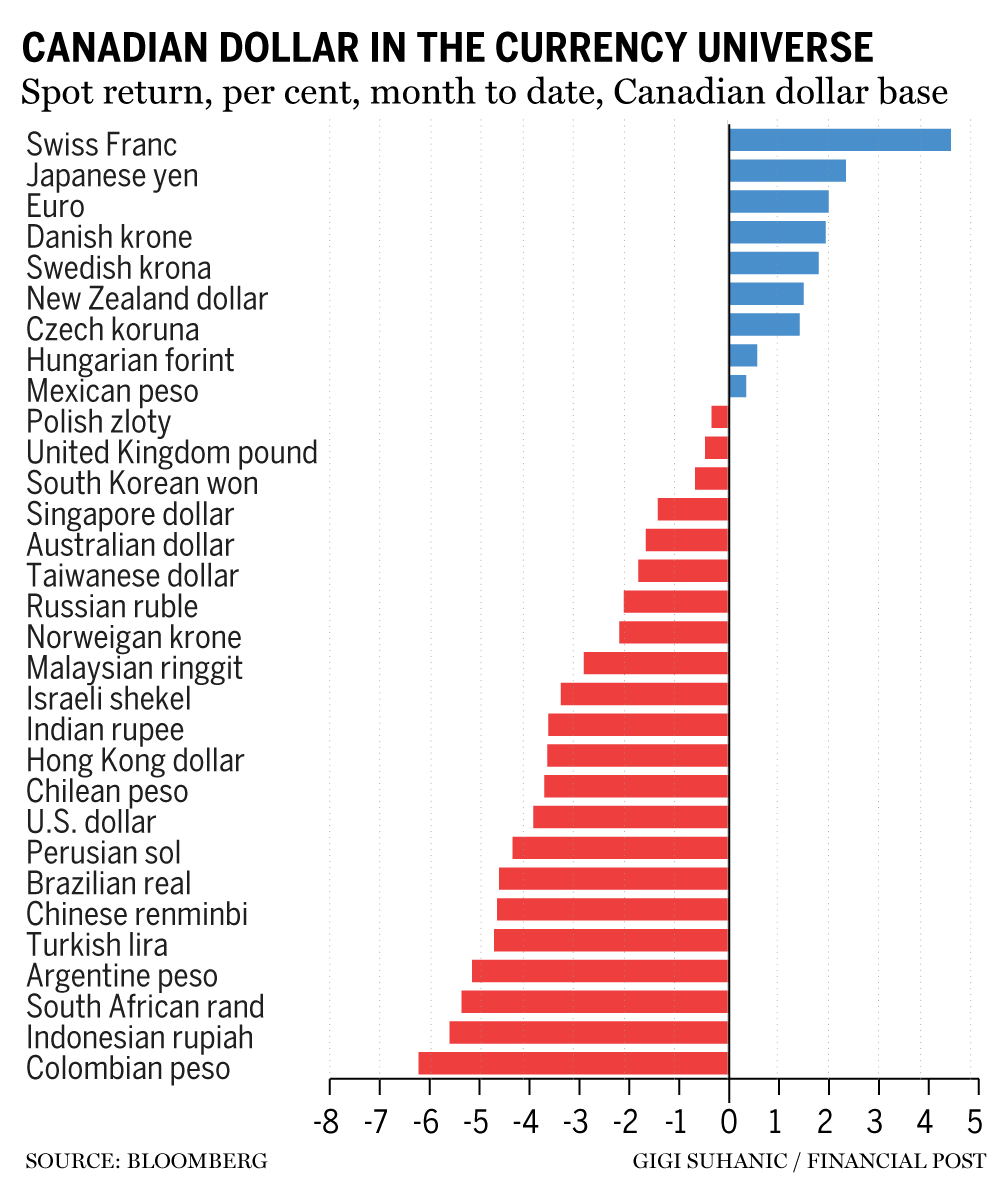

“The biggest winner from Liberation Day, the tariff threat, is the Swiss franc, yen and the euro,” Kyle Chapman, a currency market analyst at Ballinger Group, said. “(The) Swiss franc and the yen are safe haven currencies anyway — they typically tend to benefit from sort of volatile panic — and the euro as well is sort of a preferred alternative to the dollar.” The euro is not typically considered a haven currency, but it is currently benefiting from the high-risk environment. “The single currency has been a chief recipient of haven flows that would typically benefit the dollar, but that on this occasion have headed the opposite direction across the Atlantic, fleeing political chaos in America,” Nick Rees, head of macro research at Monex Europe Ltd., said in an email. The Canadian dollar is down 2.6 per cent against the euro so far this month. But the loonie is performing quite well against a basket of other denominations from Asia to Latin America, Rees said.

For example, the Canadian dollar is up against a basket of 21 currencies, from the Polish zloty and the South Korean won to the Brazilian real and Colombian peso. It has gained 5.5 per cent against Colombia’s currency in April. “The (Canadian dollar) resilience is unusual, defying not just risk conditions, but also typical sensitivities to equities and oil, with slides for both usually presaging a weaker Canadian dollar,” Rees said. The S&P/TSX composite index is down 1.5 per cent in April, while the price of West Texas Intermediate, the North American benchmark, is down 11 per cent. Rees attributes the Canadian dollar’s “outperformance” against the broader list of currencies to an easing of tariff risks.

For the moment, Canada appears to have evaded the eye of the tariff storm after it dodged reciprocal tariffs, but it is still dealing with 25 per cent tariffs on steel, aluminum and the non-U.S. share of completed vehicles.

“However, we also see Canada as holding value as an alternative to the U.S., allowing investors to retain exposure to North American growth while remaining somewhat more insulated from Trump-specific risks,” Rees said, adding he sees more upside for the loonie if Canada can “continue to dodge” the tariff threat.

But it’s hard to perceive the full scope of Trump’s policies and their fallout.

“If problems in the U.S. worsen to the point that we are facing a global economic or financial cataclysm, investors will quickly revert to their old ways, and the greenback will soar against the loonie,” Schamotta said.

Cited from: Financial Post